Because the FAT ratio focuses on fixed assets, it's more applicable to businesses in industries with large, high-value fixed assets, such as manufacturing or real estate. While both ratios compare company assets to sales, each one is more appropriate to certain industries than others. This is important information when determining which types of equipment purchases are worthwhile and don't contribute to revenue. This can indicate how much value is being introduced into the company through the use of its physical assets. They want to know the value of the sales the company produces per dollar of asset owned.

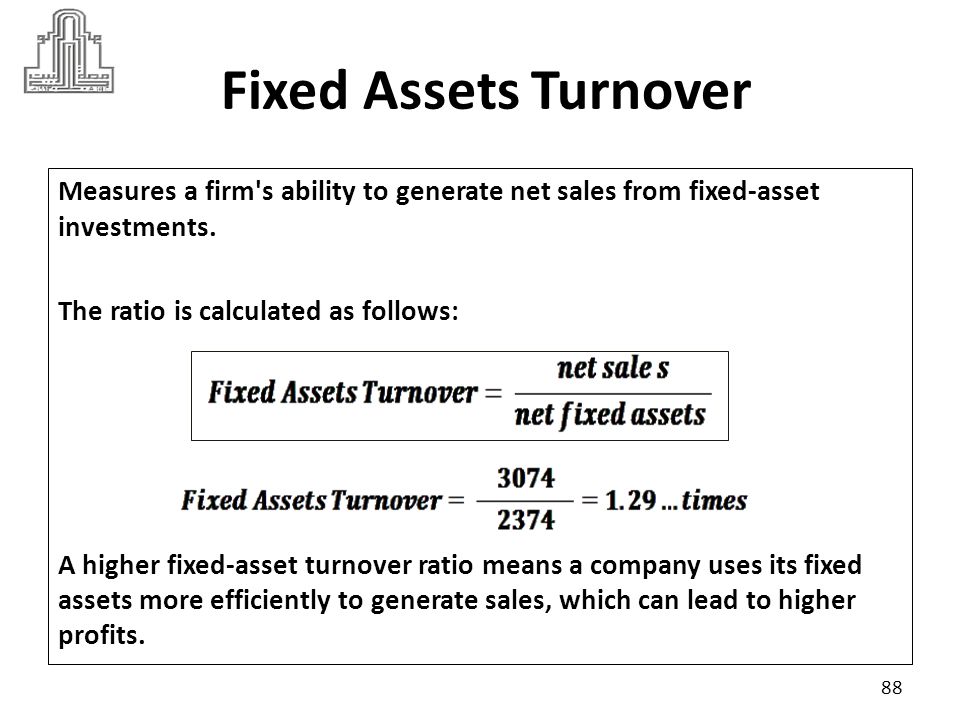

For this reason, asset turnover ratios can be more relevant in certain industries where the production of sales doesn't rely as much on the exploitation of physical assets or ones that routinely produce high sales volumes.Īnalysts generally employ the asset turnover ratio to determine the relationship between investment in assets and sales generated. This distinction between the fixed asset turnover ratio and the asset turnover ratio is important because it means that a company has included its total assets in the calculation and not just its fixed assets. The asset turnover ratio (AT) measures how efficiently companies can generate sales revenue from their collected assets. Some examples of fixed assets include machinery, vehicles, land, buildings, and computer equipment.

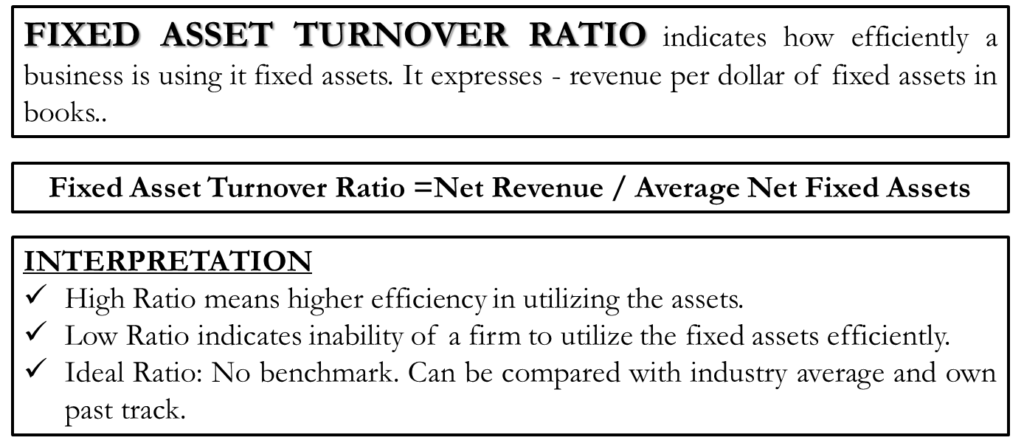

Also referred to as tangible assets, fixed assets differ from current assets in that they're expected to last longer than one year. You can add the values of a company's fixed asset base to generate a total value.įixed assets are physical assets that a company owns and uses to generate income. The fixed asset turnover ratio (FAT) is a financial metric designed to measure how efficiently a company is able to generate sales compared against the value of its fixed assets.

#Fixed asset turnover how to

In this article, we define the fixed asset turnover ratio, compare it to the asset turnover ratio, explain how to calculate it, and share some applications and limitations of interpreting this ratio with examples. By using a formula to calculate the turnover rate of a company's fixed assets, you can determine the efficiency and profitability of a business. Asset utilization ratios compare a company's investment in assets to its sales numbers to draw conclusions about the company's efficiency. A company can measure its performance in many ways, including the turnover of fixed assets.

0 kommentar(er)

0 kommentar(er)